Puzzled About Day Trading Popularity

Top Pages – Investopedia.com

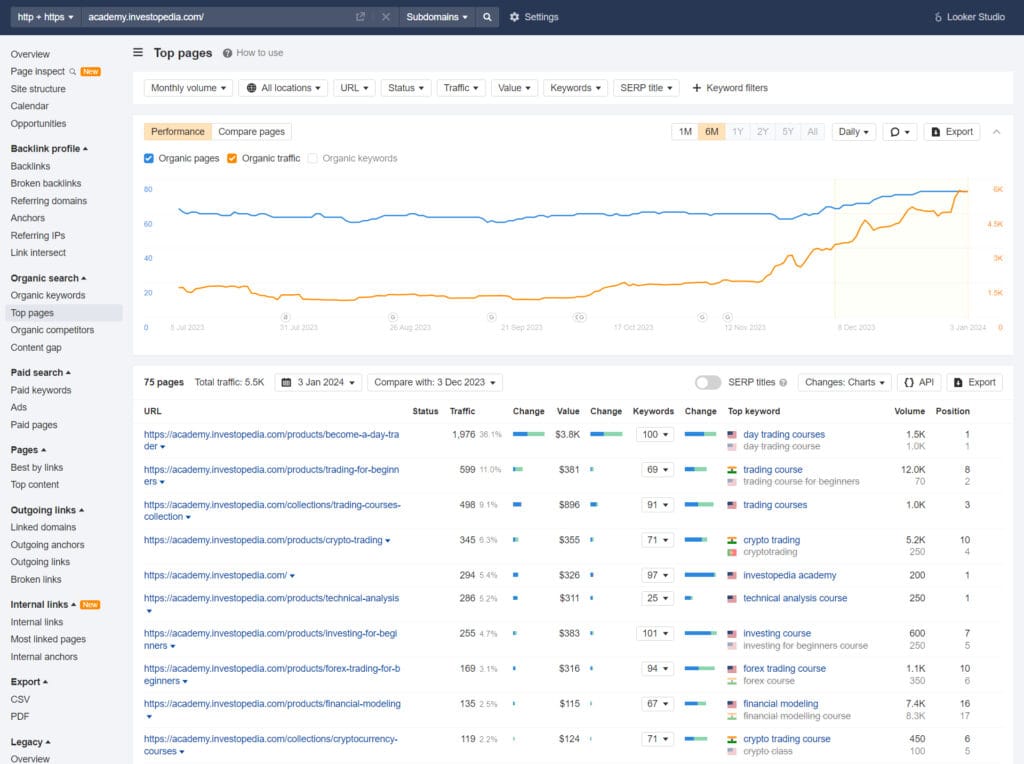

I was puzzled about day trading popularity compared with other topics on the Investopedia website. This was showing up in Google search traffic figures while I was researching the top pages of the Investopedia website recently.

Investopedia is a popular, highly ranked, source of online investment topic information and knowledge.

Investopedia also has an Academy section which offers paid online courses across a wide range of investment topics.

Become A Day Trader – Surprise Traffic

What surprised me was the Investopedia Academy ‘Become A Day Trader’ course page gets the most Google search traffic, by far. About 3 times more search traffic than each of the 2nd and 3rd most popular pages, also about trading.

The ‘Become A Day Trader’ page dominates Investopedia Academy search traffic by a country mile.

And in the last few paragraphs at the end I have a strong recommendation for anyone who is considering getting into day trading. It may help you make the right decisions for your own investment success.

But for the moment, back to the Investopedia day trading course Google search traffic surprises and being puzzled about day trading popularity.

The United States accounted for over 82% of the search traffic for the ‘Become A Day Trader’ course page. Canada, United Kingdom and India were a distant second, third and fourth respectively. They accounted for about a combined additional 14%.

Trading Brokerages Oblige

And of course all the popular online brokerages don’t hesitate to answer the call by providing very snazzy and sophisticated trader platform apps.

Business 101, why wouldn’t they – their revenue and profits come from clients buying and selling stocks and other investments. For them, the more trading the better.

Other Investopedia Investing Courses

Investopedia Academy also offers traditional investing courses, based more around fundamental analysis and long-term investing.

The Google search traffic for these investing courses lagged the day trading courses by a very long way.

To put it all in context, the ‘Become A Day Trader’ course has about 20 times more search traffic than the ‘Fundamental Analysis’ course, based on analysis results I obtained on 3 January 2024.

I would have expected that normal investing, that is long-term investing, based on fundamentals, would be more popular. Or at least in the same popularity league as trading.

But not so, as we showed above.

The first page that could be considered relating to long-term investing was ‘Investing For Beginners’. It was 5th on the Google search traffic volume list for courses with a measly 5.5% of the overall search traffic.

Long-Term Investing Courses Lagging In Popularity

It can’t be due to any scarcity of good information about long-term investing.

And just so we’re all on the same page, we can check Investopedia’s explanation of the differences between trading and investing here.

There is a wealth of information available on long-term investing, by way of great books and online sources. On top of that a quick Google search will turn up dozens of the wealthiest people on the planet who have over time built enormous businesses and fortunes through their investing prowess.

Many books have been written by and about most of them.

Anyone with even a passing knowledge of finance and investing will recognise quite a few names of these titans in long-term investing. Leaving aside the leader by a country mile of this elite club to enjoy his hamburgers and Coke, other towering figures would be Jim Simons of Renaissance Technologies (RT) (a private hedge fund!), Joel Greenblatt of Gotham Capital, the long-retired Peter Lynch from Fidelity, Howard Marks of Oaktree Capital Management, and dozens of others.

The totally fascinating thing is, the investment approaches and techniques of these exponents are all in the public domain and are relatively straightforward. Not easy to apply, mostly due to the frailties of human nature. But easy to comprehend.

And if we don’t have the temperament to apply their particular techniques, they offer very easy to apply and rewarding advice on what we should do to be successful investors in spite of ourselves.

That is, make regular contributions over time to index-based exchange traded funds.

And The Day Traders?

So, looking at day trading. And day traders in the same league?

Well, there aren’t any.

Having studied some of Jack Schwager’s books on trading, any advice from those who have reputedly been sustainably successful in day trading seems broad-brush and woolly to me. It seems more like mysticism, black magic, and moving goalposts, with wide back doors to escape too much scrutiny.

Some might consider Jim Simons a ‘trader par excellence’. True, if trading frequency is the measure. But most definitely not true if we consider the financial and human capital, and research, he has committed over the years to his craft and business. We are talking $Billions and over 100 top technology and mathematical PhDs in his organisation. He can well afford it.

Apart from that he is a veritable mathematical genius, which was the most important ingredient in his investing success.

The Lure Of Day Trading

So what is it that attracts so many to the idea of day trading?

I spent some years in the retail investment business as a regulated and qualified stockbroker and financial advisor. I was often astonished by some of the ill-informed make-believe and leaky logic that found their way into important investment decisions.

So as regards trading, I’m inclined to think the lure is all about a naive ‘Get Rich Quick’ dream. The myth of easy money. Finding some way to predict what can’t be predicted. That pipe dream sucks in a lot of people, and not just in the trading space.

Who wouldn’t jump at the chance of making a lot of money quickly – if it were realistic and likely.

All the facts and statistics show that the vast majority of people who embark on day trading fail. By that I mean lose money rather than make money.

Investing

As it turns out, it’s easy to tap into the sharpest of investment minds and get ourselves off the starting blocks and on our way to the probability of investment success. But it takes time, patience, and commitment. No shortcuts.

I can recommend one book that gives a fascinating and clear perspective on the whole investment narrative and the investing giants who occupy centre-stage in that space. It is titled ‘Richer, Wiser, Happier’, by William Green, 2021. It’s a great book and you will be glad you read it.

Disclaimer

This article is for informational purposes only, it should not be considered investment or financial advice. Investments put your capital at risk. Investments can go down as well as up. Past performance is not a reliable guide of future results. Consult an investment or financial professional before making any major financial decisions.