Google Canonical and Blog Article: “5 Things I Did Right And Wrong On The Stock Market”

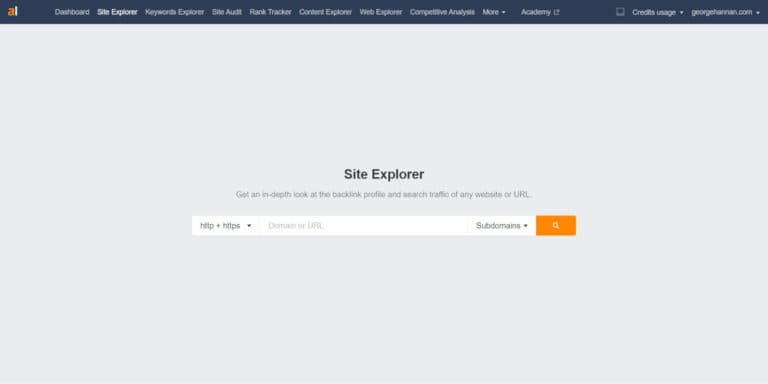

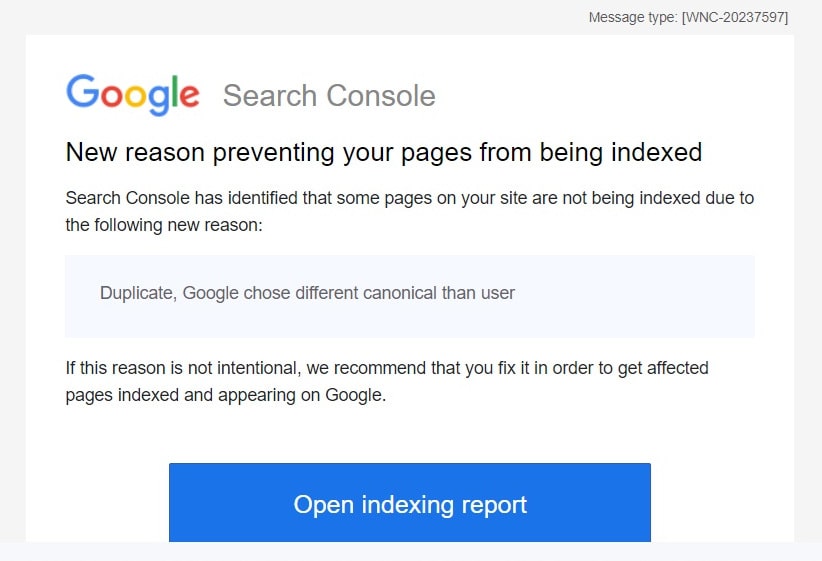

Google Over-Rides My Canonical

My original article, “5 Things I Did Right And Wrong On The Stock Market” was first published here on this blog on 26 November 2023.

I’m also a writer on Medium and on 26 December 2023 I re-published the article on Medium here, and pointing to the canonical (original source) article and link on my blog here. All fully legitimate with Medium, and correct in terms of the sequence of publication. And that’s how it should have been.

Until autocratic Google arrived on the scene and trampled all over that.

Google decided the Medium article was a better canonical source and did not index the blog post. It would have to do with the Medium site ranking being much, much higher than that of my blog.

Fait accompli, no discussion. The reality is they are taking advantage of market dominance.

That’s what happens when one company corners the Internet search space and can act pretty much as they wish. The only time they have to answer for their sins is when the weight of the likes of the European Commission hits them with a massive fine for monopolistic practices and market abuse, such as with the €2.4 Billion fine as detailed here.

So thinking about a work-around.

Since Medium is a membership platform and paywalled as such, I will repeat the content of the original article below, albeit with a different title, just to shake a little pepper up Google’s nose while they’re sniffing about.

The Stock Market: Smart And Stupid Things I’ve Done

Starting On The Stock Market

The stock market is more than a playground for the rich elites, hyper-intelligent or ‘The Wolf Of Wallstreet’ types to exploit the masses! I’ll describe here what it was like as a stock market beginner.

For sure one place that it is not, is for the uninformed or those who fall for the ‘Get Rich Quick’ spiel. Neither works here.

But it’s a fascinating place if one is fairly numerate, enjoys the dynamic of business, finance, and economies, and is prepared to put in the ongoing work. We’ll talk more about that in future posts.

I got going on the stock scene in about 1980, early in my career when I was working in a technical role in a manufacturing company.

I was very fortunate then to have a great mentor and friend, the engineering manager where I worked. Mick was a conservative, trustworthy individual who had a lot of experience on the local stock market.

As far as numeracy goes, my technical degree gave me enough to get by.

At the time I was also doing an Honours business degree. This included material on the financial structure and performance of businesses. Of course stock markets being the ideal case study.

Mick introduced me to his stockbroker and that’s how it all started. No online brokerages then. A personal introduction from an existing client and phoning or faxing in buy and sell orders was how it was done. And real, paper, stock certificates and dividend cheques! Beautiful!

And looking back on a few of the things I have done right and done wrong. Warren Buffett is in no danger of being pushed off the perch. But I’ve learned a lot and enjoy the buzz of trying to figure it all out as best I can. Here’s a summary of some of the experience gained.

5 Things I Did Right In The Stock Market

1. Get Help From People With Integrity and Experience, and Start Small

Being fortunate enough to have had Mick Bell as a friend and mentor was the perfect introduction to investing on the stock market. His stockbroker, a lady of impeccable integrity and business ethics too, got me going with a few small holdings of solid companies.

2. Solid grasp of the ‘For Profit’ motive and imperative in business

First solvency, or the cash flow to pay bills as they come due. Business survival is not possible without that. Next, profitability, or projected profitability after a reasonable start-up and early growth phase of surviving on investor capital. I worked on understanding those business imperatives.

3. Making sense of the Annual Reports of public companies

The finance and investment parts of the business degree were the perfect foundation for this. It’s vital to be able to read, understand and analyse the income statements, balance sheets and cash flow statements of listed companies of potential interest. Otherwise we are at the mercy of people who may serve their own interests ahead of ours, such as commission-driven brokers and advisors. And that perspective comes from insider experience.

There is also another great solution to the investment question – broad index-based ETFs (Exchange Traded Funds). More on those later, and they’re super products in so many ways.

4. Read The Greats

In my experience there’s nowhere more full of uninformed and unfounded ideas and beliefs (‘fantasising’ might be closer to what it is) than in investing in stocks.

I’ve kept my thinking straight by reading what some of the legends in the stock market and investment business have to say. They have long track records that can’t be disputed. Warren Buffett is ahead by a country mile. Joel Greenblatt, Peter Lynch and John Bogle are in the premier league too. I would also add a relatively new book, with a somewhat wacky title, ‘Richer, Wiser, Happier’, by William Green in there. It is quickly reaching classic status. Another important book, about Jim Simons, is ‘The Man Who Solved The Market’ by Gregory Zuckerman. More on that further down.

5. ETFs

Exchange Traded Funds (ETF) came along quite a few years ago because the buy-in and annual management fees of actively managed funds simply soaked up any significant growth these funds produced. It’s a fact that, over time, broad index-based ETFs outperform most actively managed funds. So I have most of my reserves in well-selected ETFs and I’m happy with how they have performed. But I still love the buzz of a few well-selected stocks.

5 Things I Did Wrong In The Stock Market

1. Blindly Followed The Crowd In The Dotcom Boom

It’s so easy to get caught up in a craze, especially when it involves potentially making money. I fell for the dotcom boom near the top and bought a few equities that looked good in terms of growth and acceptable p/e ratio. Well, we know what happened in the dotcom boom and I didn’t cut my losses quickly enough. Didn’t lose my shirt, but it was still an expensive lesson! The lesson: avoid getting caught up in the hype of crazes.

2. Tried Trading and Spread Betting

Not in a big way, but enough to know that any person or business seeking to teach one how to make big bucks from trading or spread betting is extremely likely to be a scam. Avoid.

I was curious enough about trading to read some of Jack D. Schwager’s books on the subject. It was enough to convince me it was 99% smoke and mirrors. A load of hot air.

3. Competing With The Big Boys

Early in the game I felt that all I had to do was analyse historical data for companies listed on the exchange in a spreadsheet. Then I could just pick the ones with the most attractive share price increase over time, in conjunction with attractive p/e ratio. All helped with the low-down on these companies in the financial and business press.

Turns out economies, business, life, and making money on the stock market are a lot more complicated than that.

For those who might feel that a few financial results, Excel, reading a few business articles and the application of a bit of Zen is all they need to make a killing on the market, I’d suggest one thing. Read ‘The Man Who Solved The Market’ by Gregory Zuckerman. The book explains what the big boys spend, $billions in terms of technology. And talent, hundreds of PhD’s, to develop systems for picking winning stocks. Make no mistake, these are the brightest of the bright with no shortage of ambition to make money or supercomputers to apply their skills. We need to be extra-careful not to let Dunning-Kruger sneak into our thinking. The central character in the book is Jim Simons, a maths professor and now an extremely wealthy man. Great book.

Forget about investing in Jim’s hedge fund, the Medallion Fund. It’s been closed to outside investors since 1993.

The lesson: it takes huge dedication and effort, plus the right temperament, to build the skills to be a good stock picker. Read the books, put in the time and work.

4. Fixation On Daily Price Movements

It’s so tempting to keep checking the prices of the stocks we hold. When newspapers were the principal source, at least it was only daily. But with online tickers now, we can sit mesmerised by the price bouncing around, and wondering what’s going on. It’s a stress factor and a mood disruptor. I would have been in this camp. The lesson: Don’t. Stock prices always fluctuate, based on more factors than we can even comprehend.

5. Privatised State Enterprises

I was extremely lucky to escape with a good profit here. When British Rail was privatised to Railtrack I applied for and was allocated a quantity of shares. Over the next few years the shares did very nicely. I can’t recall the reason I sold, but I did. Luckily. Railtrack was badly mismanaged, had several bad rail accidents due to underinvestment in infrastructure. It was eventually liquidated below the original floatation price. Lesson: don’t assume that state enterprises being privatised and floated are automatically a good investment.

Disclaimer

This article is for informational purposes only, it should not be considered investment or financial advice. Investments put your capital at risk. Investments can go down as well as up. Past performance is not a reliable guide of future results. Consult an investment or financial professional before making any major financial decisions.

Thank You

Thank you for reading my 5 rights and 5 wrongs as regards stocks. It’s a fascinating area to put in the time and effort. I would be delighted to hear your thoughts (through my contact form here).

For general helpful information on investing in stocks I have referenced a great source here

The learning and investing continue.