Investing In Stocks, Tesla and Apple vs Williams-Sonoma

The Contenders

If we are considering investing in stocks, Tesla and Apple vs Williams-Sonoma make an interesting comparative example to apply two simple tests.

The Tests

The first is return on capital (ROC) which is an indication of how good a business is. The second is earnings yield (EY), an indication if a stock is overpriced or not, relative to other possible opportunities.

We’ll look at these measures in a little more detail below. But to mention, they might be used by investors researching what might be the best long term stocks to invest in.

Day traders and the like look more to apply mysticism and black magic to try to profit from short-term price swings. Trading is something serious, and successful, long term investors don’t subscribe to, nor do I. Supported by a plethora of irrefutable, statistically valid, evidence.

Clearly there are some successful traders, but the vast majority are unsuccessful.

Of course all those who embark on trading figure they have what it takes to be the exceptions who do succeed. Which the facts demonstrate to be an impossibility. More on the facts and figures about that in future posts.

Big and Not-So-Big Hitters

Tesla and Apple are two enormous global businesses with two of the most valuable brands on the planet. Most people will be broadly familiar with the stature of these businesses.

For comparison with these behemoths, we’ll turn to a stock probably very few have heard of. Williams-Sonoma Inc., based in San Francisco, and operating as an omni-channel speciality retailer of various products for the home. Well-established and profitable.

The Background

Laying out the playing field for the comparison.

There is an incredible flood of online and offline commentary and information about investing. Even more so about investing in stocks.

Often this deluge of commentary is more confusing than helpful. Clickbait headlines dished up by the mile. But it seems to be what the masses respond to. For example, “49.1% of Warren Buffett’s $373 Billion Portfolio Is Invested in 3 Artificial Intelligence (AI) Stocks”. Typical Motley Fool rah-rah. And lots more like them. But the masses are not successful stock investors. Fact.

No, thank you.

We need to dig much deeper to get below the general speculative hype and fluff, and into good information and data.

It’s challenging. We hear lots of people opining, for example, that Apple and Tesla must be great stocks to own. Without much, if any, credible basis for such assertions.

True, they are enormous companies. Prestigious global brands. And they make profits.

It’s a good start.

Tesla and Apple, The Comparison

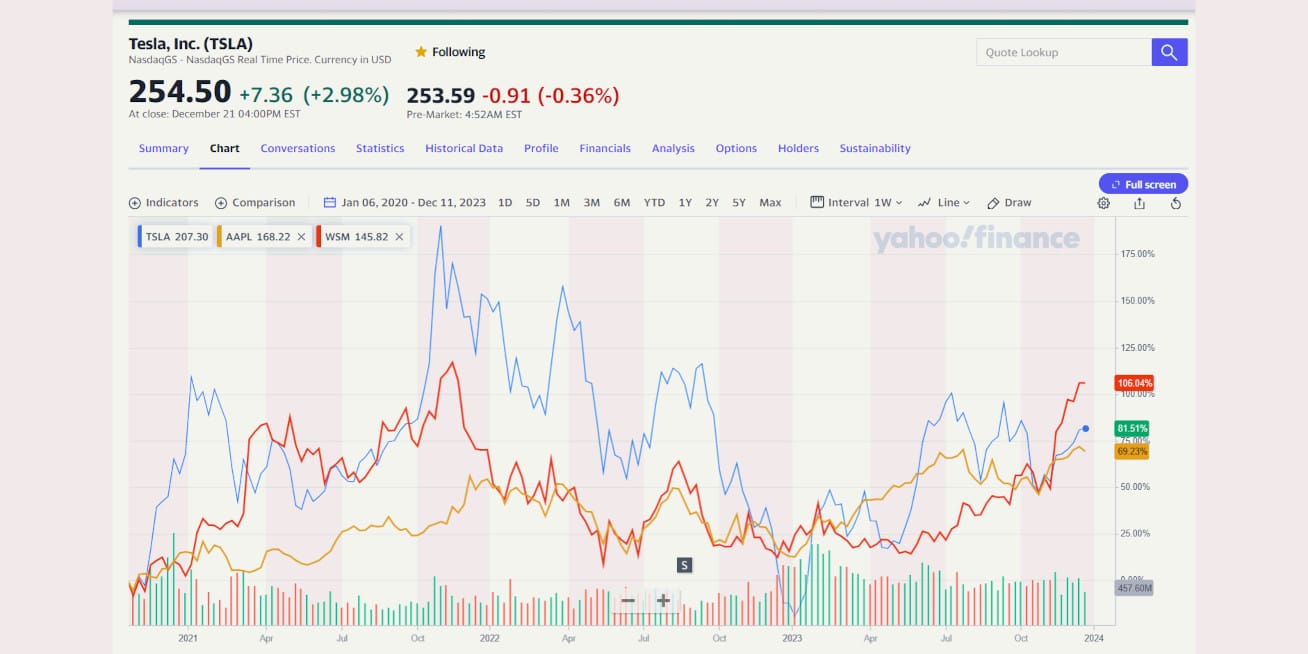

Let’s look at a few of their figures, all freely available on Yahoo Finance.

Apple’s market capitalisation (current share price multiplied by the number of ordinary shares outstanding) on Dec 19, 2023, was just over $3 Trillion (3 with 12 zeros behind it). Bigger than the GDP of many countries! They made just over $97 Billion (97 with 9 zeros behind it) net profit for their fiscal 2023.

Tesla’s market cap on the same day was almost $815 Billion, less than one-third that of Apple. They made just under $13 Billion net profit in fiscal 2022 (their fiscal 2023 is still in progress). Not bad, but only about one-seventh of Apple’s net profit. Not in Apple’s league.

Return On Capital

A measure used by many stock investment experts to classify good businesses is Return on Capital (ROC). It’s the % return earned for the most recent fiscal year on all the tangible capital employed by the business. It measures how effectively management use net working capital and net fixed assets to generate earnings before interest and tax.

On the most recent annual results, this is 36% for Tesla, and 272% for Apple. On that basis, Apple did a far better job of using the tangible capital at their disposal to earn profits. Their margins are better. So we can say, in terms of our definition, that Apple is a ‘better business’ than Tesla.

Now looking at what’s known as the earnings yield (EY) for those two businesses.

Earnings Yield Results

In long-term investing circles earnings yield (EY) is a well-known measure to estimate if a stock is selling at an attractive price. It measures what percentage a business makes relative to the purchase price of the business. Something similar to what interest rate we would get if we put a sum of money in a savings account at a bank. Obviously, the higher the better, taking risk and term into account.

Note this is not a Tesla or Apple stock price prediction. The measure is based on enterprise earnings before interest and tax, and enterprise value. Enterprise value is based on current stock prices.

On the basis of their most recent fiscal year, Tesla’s EY is 1.8% and Apple’s is 3.7%. So we could ask; why is Tesla stock so high, or is Tesla overvalued?

So again Apple comes out ahead. But are Tesla and Apple stocks currently selling at an attractive price, or are they expensive compared with other stock investment opportunities?

Williams-Sonoma Inc., The Comparison

Let’s bring Williams-Sonoma into the picture.

They have a current market cap of about $13 Billion. Not a giant business, but not small either. Their ROC is 54% and their EY is 11.1%.

Beats the pants off Tesla, for example.

Now, how might we assess and compare allthose results?

Return on Capital and Earnings Yield Comparison Table

Let’s summarise our research so far.

| Stock | ROC | EY |

| Tesla (TSLA) | 36% | 1.8% |

| Apple (AAPL) | 272% | 3.7% |

| Williams-Sonoma (WSM) | 54% | 11.1% |

So WSM is most attractively priced as a good business. It has a good EY. Apple is a great business, but expensive at the current stock price. Tesla kind of falls off the perch. From our analysis, it is the most expensive stock of the three, for the least attractive business.

We’ll look at possible reasons for these scenarios in future articles.

So how might we choose if we were considering buying one of these stocks?

More Research and Analysis Needed

Well, investing in stocks, Tesla and Apple vs Williams-Sonoma, is a short but informative analysis. Clearly, there are many problems with it. Not least of which is this analysis is a narrow snapshot of just one instance in time, based on results for a single past fiscal year. As we say in the disclaimer below, past performance is not a reliable guide to future results.

We would need to address some of those problems before we even consider using the results of this analysis to inform a decision, even partly, to invest in any of those stocks.

And maybe most importantly we also need to discuss some important mindset issues around investing.

We’ll talk more about all this in future articles.

Hence, easy to see that a lot of work and research is involved if we want to avoid the vagaries, and likely losses, of pure uninformed gambling, luck, pub gossip, hot tip blather, and so on.

So it comes down to ‘buyer beware’. Emphasised. Superior knowledge and information are our best assets and defences.

It might also be enlightening to read a few of the things I have done right, and wrong, in investing in stocks over the years here.

Disclaimer

This article is for informational purposes only, it should not be considered investment or financial advice. Investments put your capital at risk. Investments can go down as well as up. Past performance is not a reliable guide to future results. Consult an investment or financial professional before making any major financial decisions.

Thank You

Thank you for reading ‘Investing In Stocks, Tesla and Apple vs Williams-Sonoma’. I would be delighted to hear your thoughts (through my contact form here).