Stocks – Better Investing

Fundamental Investors – The Successes

Names like Laura Geritz, Ed Thorp or Nick Sleep might not pop into our minds straight away when we’re turning our attention to investing in stocks. Or thinking about investing for our financial future. Nor might names like John Templeton or John Bogle.

The irony is, these are some of the names that matter most in the investing space. They have been banking the proceeds, in serious amounts, of their investing successes for years or decades.

And these people don’t need the money by charging for their advice and wisdom, which they freely give, if we are paying attention to what matters. It’s ironic – the hucksters will often get our attention sooner than those best qualified to show us the way.

So we need to be following the money, rather than handing it out for get-rich-quick fads and gimmicks.

Investment Analysis – The Big Picture

One of the biggest challenges we have is building skills to do our own solid, rational, informed, stock analysis rather than blindly following the hype and hubbub in the media, or worse still acting on opaque street-talk, or just following the crowd.

When we’re thinking about an investment in stocks, supremo investors with proven track records, such as Matthew McLennan, Joel Greenblatt, Howard Marks, Warren Buffett, etc., have made their advice and techniques available to anyone who wishes to heed what they have to say.

Some background in investing in stocks in general is given here.

Bargain Stock Price In Good Business

The investor greats above recommend asking ourselves two questions.

First, are we considering investing in a good business, and second, is there a margin of safety in the stock price. In other words, is the stock at a bargain price.

Let’s suppose we can answer an informed ‘Yes’ to both questions. Taking account of the fact nothing is 100% certain, we’ve then stacked the odds in our favour as far as we can.

That leaves us with a much greater chance of making a successful investment than just taking a punt, following the crowd, buying a sexy stock because it’s sexy, or a haphazard gamble based on some random news story.

Overabundance Of Intelligent People – Competing For Financial Success

Of course arriving at an informed ‘Yes’ takes some serious skill, data, effort and judgment. But when we get into it, it’s fascinating. And if we step up to the challenge of building real skills at evaluating investments, particularly stocks and exchange traded funds (ETF’s), it can open up new worlds.

Not only will we be making big steps in securing our financial futures, but there will be no shortage of important people who will be happy to have conversations with us!

Thinking for a moment about what another of the true greats, Peter Lynch, said. He’s the retired and humongously successful manager of the Fidelity Magellan fund, which achieved annualised returns of 29% between 1977 and 1990.

Lynch said, “the investment business is so rewarding financially and intellectually that it attracts an overabundance of intelligent people.”

So be warned, investing is an ultra-competitive pursuit. We’re up against some very clever people. If we don’t know what we’re doing, we’re toast, and our hard-earned money will disappear very quickly.

Investments Analysis – Information Sources

Just to be clear, there is a lot more to analysing a stock than just ticker prices and listening to blowhard commentators.

We first need to take a view on the economic and competitive environments that the business is operating in.

Generally, reading the most recent annual reports, available online, and searching for the company on news feeds like Yahoo Finance, Bloomberg, etc., will be a good start.

As we build skills we will develop our list of preferred news and information sources.

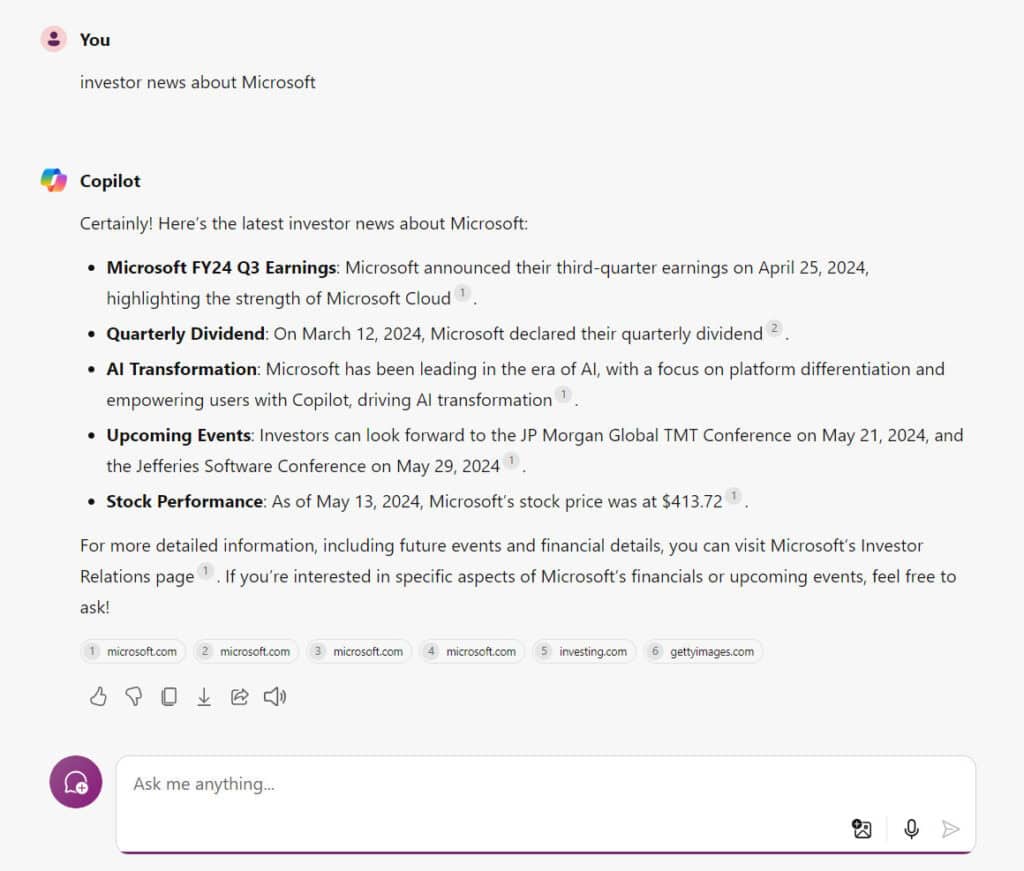

Online brokerages also have newsfeeds that can usually be searched for specific companies. I found Microsoft Copilot (they call it ‘Your Everyday AI Companion’) useful too. For example inputting the query ‘investor news about Microsoft’ into MS Copilot returns recent articles relevant to investing in Microsoft (MSFT).

There’s no prescribed best practice in terms of reading up on our potential target stocks. But it’s an important part of an informed process of stock selection. There is a risk we might over-saturate, so we need to make some practical judgements on a sensible balance.

Investment Analysis – Company Financial Statements

Along with a feel for the business environment and competition the company faces, we also need to evaluate the company income statement and balance sheet. It’s best to compare financial figures from the most recent annual report with several years of historical data. These should be available from the data sources we mentioned earlier.

People such as the investor titans mentioned earlier use financial ratios to help judge a good business, and if the stock price is attractive. Let’s look at some of those.

Return On Capital and Earnings Yield

Two of the favourite ratios are Return on Capital (RoC) and Earnings Yield (EY).

RoC is an indication of a ‘good business’, and how effective business management is at utilising the capital invested in the business to generate profits.

The formula is: RoC = EBIT / (WC + NCA) where

EBIT is earnings before interest and taxes. We use the value from the trailing 12 months

WC is working captial (current assets minus current liabilities)

NCA is non-current assets (fixed assets plus long-term debt), minus Intangible Assets, specifically goodwill.

EY is an indicator of how expensive, or how much of a bargain, the current stock price is. It how much a business earns relative to the purchase price of the stock

The formula for is: EY = EBIT / (Market Capitalisation + Long-term Debt) where

EBIT we have explained before

Market Capitalisation is the current stock price multiplied by the number of ordinary and preference shares outstanding

Long-term Debt is debt not due for repayment within 12 months

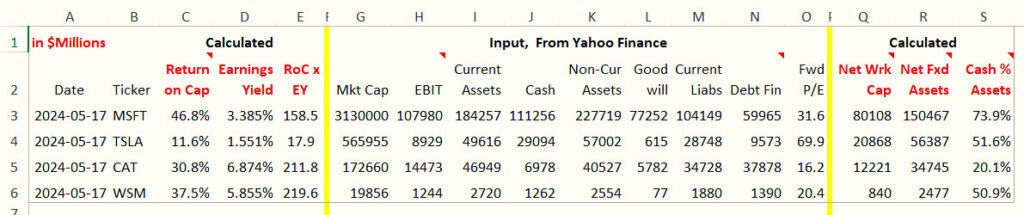

Comparisons: MSFT, TSLA, CAT, WSM

In the table below I’ve compared RoC and EY across three big, well-known businesses, Microsoft (MSFT), Tesla (TSLA) and Caterpillar (CAT), and one much smaller relatively unknown retailer, Williams-Sonoma (WSM). Data was from Yahoo Finance.

It throws up some interesting results.

I multiplied RoC and EY together to form a composite, equally weighted, index.

CAT and my small unknown selection, WSM, are neck-and-neck in terms of good businesses and attractive stock pricing. The largest business on the planet, MSFT, comes in below those two. But of course Microsoft’s track record is exemplary and it’s the largest business on the planet by market cap.

And the supposed sexiest company on the planet, TSLA, if you don’t count NVIDIA, looks pretty dismal compared with the others, particularly the diminutive WSM. Essentially the stock appears to be way over-priced and they have a very low return on capital employed. The mystique of Elon Musk might be a factor, whatever value that may impart on the stock.

The next task is to take a view on what’s being said in the newsfeeds, coupled with analysis of financials as we have done here, current and the past perhaps three or four years. We then need to judge if the stock price is attractive and likely to provide good returns in the years ahead. What we’re really looking for is where the market has underpriced the stock of good businesses. If prices are not attractive, it’s not a good time to invest. Stocks – better investing, may be simple. But not easy.

Disclaimer

This article is for informational purposes only, it should not be considered investment or financial advice. Investments put your capital at risk. Investments can go down as well as up. Past performance is not a reliable guide of future results. Consult an investment or financial professional before making any major financial decisions.