Artificial Intelligence – Better Investing

The Buzz Around Artificial Intelligence (AI)

Artificial Intelligence, or AI, seems to be on everyone’s mind in recent times. Acres of media space have been devoted to what it might mean in terms of its impact on just about any domain of human endeavour we care to think of.

Whether and by how much the hype exceeds the reality remains to be seen. But the big hitters in the technology space are paying a lot of attention and flashing their outsize cheque books to vie for centre-stage. For example, Microsoft put up USD13 billion not long ago to fund just a cooperative agreement with OpenAI of ChatGPT and DALL-E fame.

The AI Sector and The Private Investor

So it wouldn’t be out of place for the private investor to be thinking about it as a possible sector of interest either. But current valuations of some of the potential targets are eye-watering to say the least. All in expectation of rosy futures. So in our state of fantastical optimism are we simply prepared to pay anything to get in on the action, or what? Does it make any sense?

Back in June 2024 I wrote an article on Medium.com focused on some of the heavyweights in the AI space, from the perspective of considering investing in some of the stocks.

I have since cancelled my Medium.com membership and deleted the article from their archives. Reason being, they are no longer a worthwhile platform to which to commit writing effort. But I still have the script and will post it as an updated article on this blog soon.

Key Factors In The AI Race

My interest in AI is from both the perspective of a private investor, and some insight as a technologist with experience in machine learning (ML) and natural language processing (NLP) on large data sets just a few years ago – key building blocks in AI models. But that’s only scratching the surface in terms of information to make rational investment decisions.

Another important aspect to understand is the scale of data and data centres required to be a serious contender in the AI space, and the handful of high profile tech mega-businesses currently in that league. Big data is key to AI deep neural network model training. To illustrate the point, it’s fascinating to have a look at the scale of Microsoft’s data centre operations here.

The AI Space Big Hitters

A quick Google search will identify the key players in the AI space, and there will be few surprises. Sometimes the informed technical journals leave out one or another for no apparent reason. But most of the time the expected names appear.

Those would be, in no particular order, Apple, Microsoft, Alphabet (Google parent), NVIDIA, Amazon (Amazon Web Services) and Meta (FB parent). Some include Tesla in view of their Full Self Driving (FSD) and Robotaxi technologies. Others include Palantir for their enterprise AI software expertise and installed base. Businesses like Salesforce are also mentioned from time to time. Of course they all project an aura of Top Dog in the AI space, and conservatism isn’t the style of their CEOs in describing their projections.

I’ve discounted Tesla (way overpriced anyway) and Meta from my analysis as they are not on the broad business cutting edge, and I’ve included Palantir as a potential rising star given their inroads with US Government agencies.

So it’s anybody’s guess who will dominate AI, and how, in the next 5 to 10 years. As always, there will be winners and also-ran’s. That contest will be kilometres above the heads of 99.999% of people to even comprehend, much less forecast an outcome.

The AI Space – Possible Winners

There’s little doubt it’s the leadership and management of companies like these, and any others that emerge in the meantime, which will determine the future AI landscape.

But, Microsoft, Alphabet, Apple and Amazon have one notable advantage in common, right now, in the AI domain. That is access to massive quantities of data through their normal global business operations, and data centres at scale globally. As I pointed out above, this is key in training advanced AI deep learning neural network models.

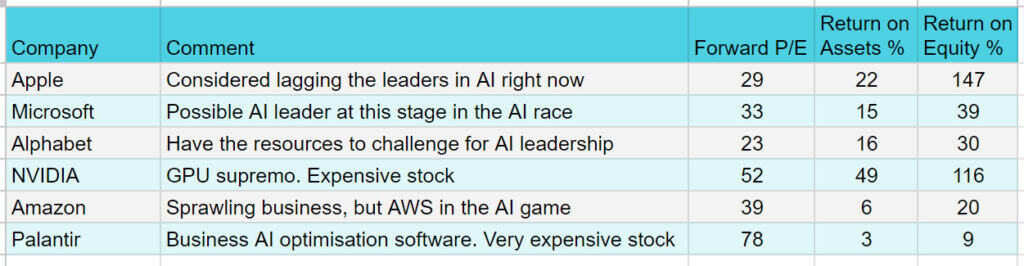

To attempt to grade these businesses, we can compare a few key ratios from financials provided on Yahoo Finance some weeks ago, as illustrated below. The most up to date figures many differ so I recommended that one should make their own analysis and decisions.

AI Investment Analysis

Different investors might view these figures in different ways, but what follows is my interpretation.

Palantir is way too expensive at the current price, with a forward price to earnings (pe) and price to sales (ps) ratios of about 78 and 26 respectively. Their returns on assets (roa) and equity (roe) are also weak. Business AI optimisation software produces their only revenue stream. If they stumble the stock price might take a hit which might make them a possible acquisition target.

NVIDIA are a brilliant company, the leader by far in the manufacture of cutting-edge GPU’s for AI, datacentres and network infrastructure. Great return on assets and equity. But their stock is also too expensive right now, leaving no margin of safety.

Amazon, through their AWS AI services, are somewhat expensive at a forward pe ratio of 39. Their roa and roe are also low compared with their peers. And they haven’t been talking up their AI strategy. Pass at this point.

Apple is not outrageously priced with a forward pe of 29. Their roa and roe are good enough. But Apple has a lot of debt, and their AI strategy also seems to be on the back foot, based around an OpenAI ChatGPT overlay on the latest iPhones supposedly driving massive upgrade revenue. And they might manufacture their own AI chips. So let’s see, but Apple wouldn’t be my first choice.

I prefer Microsoft to Apple. Arguably the dominant AI player right now, with Microsoft Copilot and other generative AI Cloud services. Their stock price is a bit high but not out of the park at a forward pe of 33, and their roa and roe is up there. Cash-rich and reasonable debt to equity ratio at around 42%. MS also seems to consistently outperform the S&P500 index by a healthy margin.

Choice

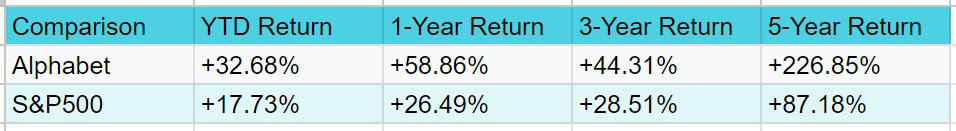

Right now my AI stock choice would be Alphabet (GOOG). Their stock is attractively priced at a forward pe of about 23. Leaving me a little more comfortable about a margin of safety in the tech space, albeit slim. Their roa and roe is there or thereabouts. They have low debt, at 10% of equity, and are cash-rich. They have been making headway with the Google Gemini generative AI suite and Google Cloud AI & Machine Learning products and services. Although they haven’t been hitting the headlines too much about their overall AI plans and strategy. They have also consistently outperformed the S&P500 by a significant margin.

The table below shows what I mean. And it illustrates the potential benefit of picking a winning stock over, for example, holding an index fund, in this case the S&P500.

Investment Risks

I have written an article on investing for financial success here. Knowledge is our most important tool for success and reducing risks in investing.

But how might we feel about the investment risks of a single stock exposure to a particular sector? A look at ways of reducing this risk through investing in relevant funds will follow soon.

Thanks

Thank you for reading.

Disclaimer

This article is for informational purposes only, it should not be considered investment or financial advice. Investments put your capital at risk. Investments can go down as well as up. Past performance is not a reliable guide of future results. Consult an investment or financial professional before making any major financial decisions.